Solana Epoch 801, Centralization Risk and the Future of Staking

What Happened in Epoch 801?

Epoch 801 on the Solana blockchain, spanning June 11–13, 2025, became more than just another period of reward distribution and validator rotation it marked a moment of intense discussion about the network’s future decentralization and validator sustainability.

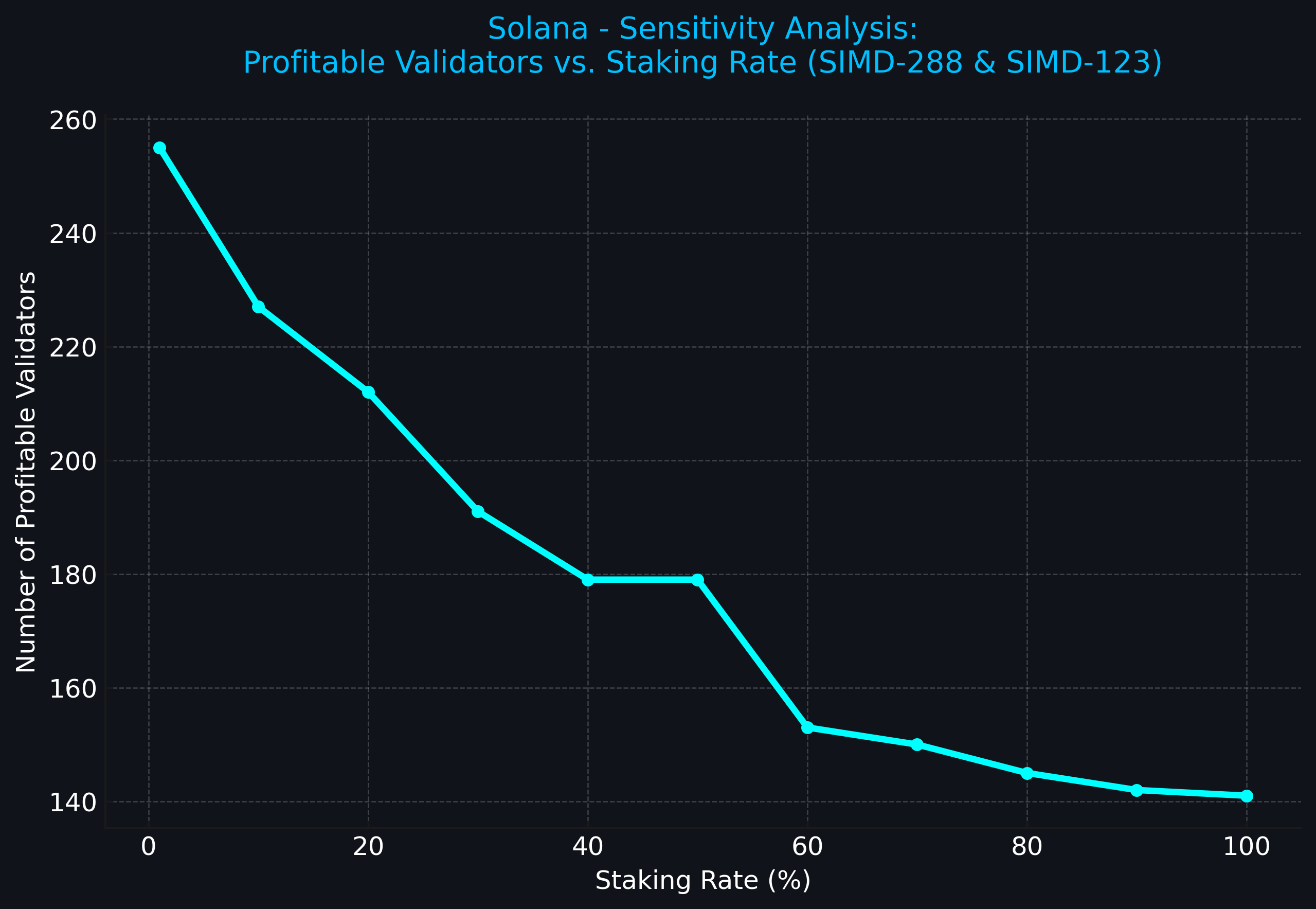

While the technical epoch itself went by without any protocol outage, a storm was brewing behind the scenes: a controversial governance proposal, SIMD-123, was being actively debated a proposal that could reshape how rewards are distributed between validators and stakers.

SIMD-123 proposes to distribute 95% of block rewards directly to stakers, bypassing validators. Currently, validators receive block rewards and distribute them manually (or through stake pool arrangements), using commission rates to earn revenue. SIMD-123 would change this flow, leaving validators with only:

- 0–5% of the block rewards, unless they set higher commission rates,

- Priority fees (tips) from MEV and transaction fees,

- No direct control over reward distribution.

This has raised serious concerns across the validator community. A wide range of small and mid-sized validators say the proposal could cripple their sustainability, potentially forcing them to shut down. Key concerns include:

- Operational costs: Running a performant validator requires expensive infrastructure. Many small operators are barely breaking even with 100k–300k SOL staked.

- Stake pool pressure: With reduced rewards, large stake pools could push validators to set commissions to 0%, further undercutting their income.

- Barrier to entry: New validators may be unable to enter the ecosystem without large capital or subsidies.

Basically, 150/1400 validators have more than 300k stake, which means ~90% are small validators relying on SFDP and stake pools. They’ll be impacted negatively.

Validator Distribution by Stake (Approximate Breakdown)

| Stake Range (SOL) | Validators | Total Stake |

|---|---|---|

| 100 – 100,000 | 903 | 28M SOL |

| 100,001 – 300,000 | 288 | 54M SOL |

| 300,001 – 1,000,000 | 67 | 36M SOL |

| 1,000,000+ | 84 | 267M SOL |

This reveals a deep asymmetry in the voting power: even if 85% of validators vote against SIMD-123, the top 10% of validators (by stake) can push it through.

Impact on Delegators and People With Large Staking Positions

While the proposal is marketed as pro-delegator, its impact is more complex:

Potential Benefits for Delegators

- More rewards: Delegators would receive 95% of block rewards directly, possibly increasing net APY.

- Transparency: Automated reward distribution may reduce hidden fees or validator misbehavior.

- Staker empowerment: Delegators may gain more control over their earnings and validator selection.

Long-Term Risks to the Ecosystem

- Validator shrinkage: If many small operators exit, validator count drops, and the network centralizes.

- Security threats: Fewer validators mean fewer independent nodes verifying transactions—raising risks of collusion or censorship.

- Reduced competition: Large validators may dominate, limiting user choice and innovation.

Validator ily-validator put it bluntly:

If SIMD-123 is passed, validators other than the major ones will not survive.

The Bigger Picture: Why This Matters in Epoch 801

The debate around SIMD-123 came into sharp focus during Epoch 801 because:

- It represented a shift in governance power, where economic control is moving toward larger stake holders.

- It questioned Solana’s decentralization narrative, which has long promoted scalability without compromising validator diversity.

- Validators were discussing whether their vote even mattered, given the stake weighted governance model.

What Comes Next?

If SIMD-123 Passes:

- Expect a consolidation wave: Small validators may shut down or merge.

- Increased reliance on Foundation delegation (SFDP) to preserve decentralization optics.

- Potential regulatory benefits for transparency, but at the cost of validator diversity.

If SIMD-123 Fails:

- Validators retain control over rewards.

- Stake pools and SFDP continue playing a central role.

- Solana may explore softer incentives or opt in reward redirection models.

Recommendations for Stakeholders

For Delegators:

- Reevaluate your validator choices support low commission, high performance nodes that promote decentralization.

- Diversify stakes across multiple validators to reduce reliance on giants.

For Validators:

- Consider commission adjustments and MEV strategies (e.g. via Jito) to remain sustainable.

- Engage in governance transparently, vocally, and with your delegators’ awareness.

For Solana Foundation:

- Build transition support for small validators if SIMD-123 passes.

- Reaffirm commitment to decentralization with concrete metrics and thresholds.

Epoch 801 marked more than just a checkpoint in time, it spotlighted a philosophical and structural debate at the heart of Solana’s future. The SIMD-123 proposal underscores the tensions between efficiency, rewards, and decentralization in a fast evolving blockchain landscape.

Solana’s next steps, whether embracing SIMD-123 or finding a middle path will likely define the validator economy for years to come. And for anyone with substantial stake in Solana, both financially and ideologically, this is a turning point not to ignore.